Payment EMI license: what it is, how to get a license

In order to carry out any operations with E-money, you must obtain a license. This is a legal document that entitles its holder to conduct financial activities in accordance with the laws of the country where such a document is issued. Thus, you can legally work as an exchanger and provide exchange services. The EMI license is issued by the regulator of the jurisdiction in which the decision was made to conduct financial activities.

Basic types of payment systems

There are a number of features by which payment systems are classified into several types. Looking at the financing instruments, experts break up payment systems into the following groups:

Those using smart cards – a separate account is set up for each one, and the cardholder is able to carry out legal transactions online (make payments and account to account transfers, etc.)

Virtual payment systems operating e-money. This type of settlements is popular with users working in the online domain and also with customers of online shops operating via accounts set up in domestic or overseas banks

If one considers the financial transaction parties, payment systems are divided into:

Bank systems – only lending institutions participate (settlements are made between banks)

Inter-entity systems – they are designed for settlements between different companies. Both cash and non-cash can be involved in the transactions.

The simplest classification is domestic and international payment systems. International systems such as Visa and Mastercard operate worldwide, while domestic payment systems are established within a specific country to ensure the security of national settlements.

EMIs and PSPs: How to obtain?

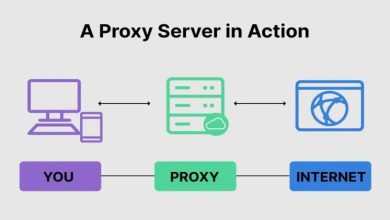

EMI (Electronic Money Institution) is an entity authorized to issue electronic money and enable payments associated with e-money.

Payment Service Providers (PSPs) are payment entities participating in the financial market and acting under the Law on Payment Services and Electronic Money. These entities are authorized to carry out payments in keeping with their registration and licensing conditions.

A payment entity’s function is to provide financial intermediation for client payments. Payment entities constitute a channel of cash flows that do not belong to them.

Opening a payment system account is easier, quicker, and more efficient than a traditional bank account. SBSB specialists are highly experienced in setting up accounts in payment systems. We will help you choose the optimum payment system for your business.